nebraska sales tax calculator

Nebraska has a state sales and use tax rate of 55. Lincoln is located within Lancaster County Nebraska.

![]()

Nebraska Income Tax Calculator 2022 With Tax Brackets And Info Investomatica

You can use our Nebraska Sales Tax Calculator to look up sales tax rates in Nebraska by address zip code.

. Nebraska provides no tax breaks for Social Security benefits and military pensions while real estate is assessed at 100 market value. You can find these fees further down on the page. A full list of these can be found below.

Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase. Local tax rates in Nebraska range from 0 to 2 making the sales tax range in Nebraska 55 to 75. In addition to taxes car purchases in Nebraska may be subject to other fees like registration title and plate fees.

The Nebraska State Sales Tax is collected by the merchant on all qualifying sales made within. Simply click on the State that you wish to calculate Sales Tax for. The Nebraska NE state sales tax rate is currently 55.

A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020. Depending on local municipalities the total tax rate can be as high as 75 but food and prescription drugs are exempt. Please select a specific location in Nebraska from the list below for specific Nebraska Sales Tax Rates for each location in 2022 or calculate.

31 rows Sales Tax Calculator Sales Tax Table The state sales tax rate in Nebraska is 5500. A sales tax is a consumption tax paid to a government on the sale of certain goods and services. Nebraska sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache.

Nebraska collects a 55 state sales tax rate on the purchase of all vehicles. The base state sales tax rate in Nebraska is 55. Also effective October 1 2022 the following cities.

All numbers are rounded in the normal fashion. To calculate the sales tax amount for all other values use our sales tax calculator above. Sales Tax Table For Lincoln County Nebraska.

Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 605 in Nebraska. 1500 - Registration fee for passenger and leased vehicles. Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information.

The Nebraska Sales Tax Comparison Calculator allows you to compare Sales Tax between all locations in Nebraska in the USA using average Sales Tax Rates andor specific Tax Rates by locality within Nebraska. This includes the sales tax rates on the state county city and special levels. In Nebraska the sales tax percentage is 55 meaning that you pay 55 of your vehicles value in addition to the total value of the car.

The most populous location in Hitchcock County Nebraska is Culbertson. Fairbury is located within Jefferson County NebraskaWithin Fairbury there is 1 zip code with the most populous zip code being 68352The sales tax rate does not vary based on zip code. As far as sales tax goes the zip code with the.

Nebraska is a destination-based sales tax state. To calculate the sales tax amount for all other values use our sales tax calculator above. 2017 Nebraska Tax Incentives Annual Report.

This is a printable Nebraska sales tax table by sale amount which can be customized by sales tax rate. Nebraska has a 55 statewide sales tax rate but also has 334 local tax jurisdictions. Within Lincoln there are around 28 zip codes with the most populous zip code being 68516.

Current Local Sales and Use Tax Rates and Other Sales and Use Tax Information. This includes the rates on the state county city and special levels. In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax.

So whilst the Sales Tax Rate in Nebraska is 55 you can actually pay anywhere between 55 and 75 depending on the local sales tax rate applied in the municipality. Sales Tax Rate s c l sr. The Nebraska state sales and use tax rate is 55 055.

Sales Tax Table For Nebraska. The average cumulative sales tax rate in Fairbury Nebraska is 75. For vehicles that are being rented or leased see see taxation of leases and rentals.

The Nebraska State Nebraska sales tax is 550 the same as the Nebraska state sales tax. Registration fee for commercial truck and truck tractors is based upon the gross vehicle weight of the vehicle. The Nebraska state sales and use tax rate is 55 055.

Each State Sales Tax Calculator uses the following Sales Tax formula to calculate the specific rate or tax that is applied at the point of sale. Sales tax is calculated using the percentage of the items value that must be paid in addition to the full price of the item. Just enter the five-digit zip code of the location in.

Average Local State Sales Tax. The sales tax rate does not vary based on zip code. The Registration Fees are assessed.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. Registration fee for farm plated truck and truck tractors is based upon the gross vehicle. Maximum Possible Sales Tax.

With local taxes the total sales tax rate is between 5500 and 8000. All numbers are rounded in the normal fashion. Nebraska State Sales Tax.

The sales tax rate does not vary based on location. The average cumulative sales tax rate in Lincoln Nebraska is 688. Nebraska Department of Economic Development.

So no matter if you live and run your business in Nebraska or live outside Nebraska but have nexus there you would charge sales tax at the rate of your buyers ship-to location. Find your Nebraska combined state and local tax rate. This chart can be used to easily calculate Nebraska sales taxes.

55 Rate Card 6 Rate Card 65 Rate Card 7 Rate Card 725 Rate Card 75 Rate Card 8 Rate Card Nebraska Jurisdictions with Local Sales and Use Tax Local Sales and Use Tax Rates Effective January 1 2021 Local Sales and Use Tax Rates Effective April 1 2021. The most populous zip code in Hitchcock County Nebraska is 69024. Below is a table of common values that can be used as a quick lookup tool for an average sales tax rate of 583 in Lincoln County Nebraska.

In this section we provide a suite of Sales Tax Calculators one for each of the States that applies Sales Tax in 2022. The average cumulative sales tax rate between all of them is 55. You can look up your local sales tax rate with TaxJars Sales.

Notification to Permitholders of Changes in Local Sales and Use Tax Rates Effective October 1 2022 updated 06032022 Effective October 1 2022 the village of Bruning and the city of Humboldt will start a local sales and use tax rate of 15. While many other states allow counties and other localities to collect a local option sales tax Nebraska does not permit local sales taxes to be collected. Maximum Local Sales Tax.

Sales Tax On Grocery Items Taxjar

How To Calculate The Nebraska Sales Tax On Cars Woodhouse Nissan

Income Tax Calculator 2021 2022 Estimate Return Refund

Nebraska Sales Tax Information Sales Tax Rates And Deadlines

Nebraska Income Tax Calculator Smartasset

Calculate The Sales Taxes In The Usa For 2022 Credit Finance

Sales Taxes In The United States Wikiwand

State Corporate Income Tax Rates And Brackets Tax Foundation

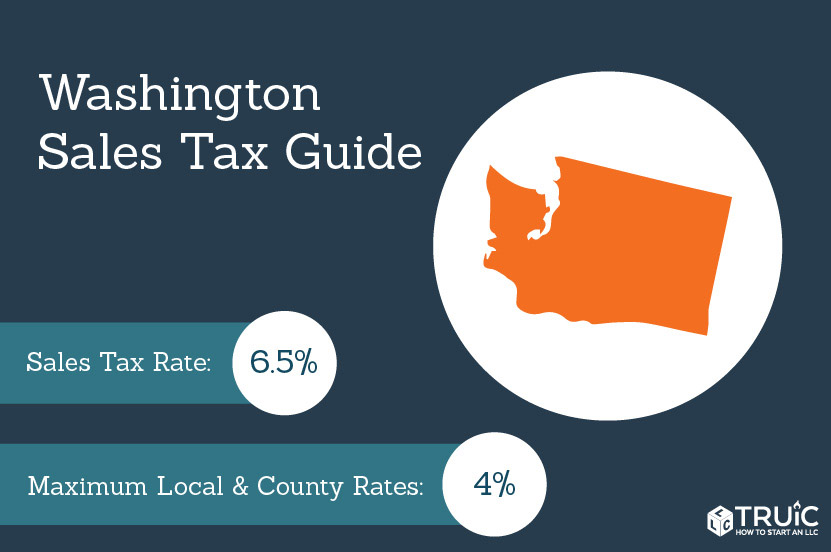

Washington Sales Tax Small Business Guide Truic

Annual Tax Calculator Us Icalculator 2022

11 9 Sales Tax Calculator Template

Nebraska Sales Tax Rates By City County 2022

States With Highest And Lowest Sales Tax Rates

Sales Tax Calculator For Purchase Plus Tax Or Tax Included Price

Nebraska Income Tax Calculator Smartasset